Estate Planning Lawyer NJ

Across the world, nearly everyone should be making decisions over how they are planning for their future; one critical component to this process is to reach out to our NJ estate planning lawyer. Estate planning can be beneficial to many individuals and not just the rich. At Klenk Law, our team of experienced New Jersey legal professionals can assist with your estate planning needs. While the process of estate planning can feel daunting, it doesn’t have to be. Nearly 50% of all Americans put off estate planning, a staggering number that leaves those who fail to do estate planning at risk for having their voices silenced for the long term. Getting a head start on your estate plan allows you to be ready for the future. When you have an estate plan set up, it will give you and your loved one’s peace of mind. By taking the time to prepare information prior to our meeting properly, our team can assist with developing your estate planning in a way that takes the pressure off while also providing peace of mind in knowing that your wishes are clearly outlined.

The Basics of Estate Planning

An estate plan consists of many legal documents and putting one together can be quite a long process. It can be overwhelming and emotionally difficult since you are making decisions that will have a lasting impact on your loved ones. The documents contain information about healthcare decisions to be made in your later stages of life, as well as the security of your assets and who they will be handed down to after your death. Making an estate plan can be a challenge if you have high-value assets or multiple assets.

An estate plan will not look the same for everyone. You get to choose which documents to include according to your goals and preferences. Common documents included in an estate plan include a will, living will, trust, powers of attorney, and advanced directives. No matter what you decide to include in your estate plan, it should be clear and highly detailed so that it can be executed according to your exact wishes.

Entrusting a skilled estate planning lawyer who understands your concerns and will help you accomplish your estate planning goals can make the process more manageable. Estate planning can be highly complex, so having the help you need can take a lot off of your shoulders. They can assist you with any part of the estate plan, suggesting recommendations on how you should organize it. With the support of a lawyer, you can be reassured that your needs will be taken care of.

Preparation Ensures an Easy Process

At Klenk Law, we are committed to helping you with every part of the estate planning process. Once you have scheduled an appointment with our firm, you should take the time to prepare for our first meeting. While navigating the estate planning process can feel overwhelming, with our assistance, we can develop a plan that clearly outlines your wishes for the future. If you have any questions about how estate planning works, or need an explanation of the legal terms, we are happy to help you. There is a lot to understand when it comes to estate planning, so we want to assist you and ensure that you have the guidance that you need to create the plan that’s right for you.

You have worked hard to build your life, and you deserve to see your assets distributed and your wishes carried out. If you do not make an estate plan, there is a risk that the state will not make decisions according to your wishes. Things may be left up to interpretation if you do not provide clear instructions regarding the distribution of your assets. Knowing essential estate planning tips can help you avoid pitfalls that can be difficult or costly to correct. By providing the following, our NJ estate planning lawyer can help make critical decisions for the future that help ensure your loved ones can carry out your legacy:

Put together a list so that you can stay on task.

When at your first appointment, there will be much to discuss, and it can be easy to get off track or feel lost over what to happen next. Before your first appointment, take the time to put together a list of questions you may have regarding the process. By doing this ahead of time, you will make sure that you stay on task and feel as though your meeting with us is as productive as possible.

Be thinking about your beneficiaries.

Chances are, you already have a good idea of who you want to manage your estate, take care of your children, and leave your assets. However, sometimes, people may still feel unsure. Start thinking about these critical decisions and list their important details such as name, address, date of birth, ages, etc. Our team can provide assistance through this process by ensuring that all beneficiaries are identified and that you have backup heirs, executors, and guardians should they be necessary.

Bring information about your assets.

Information regarding your assets, real estate property, and personal property is imperative when developing an estate plan. While taking an inventory may take some time, bringing this information can help our team review your situation and develop options for you. For example:

- Bank Accounts

- 401K/Retirement

- Life Insurance Policies

- Pensions

- Real Estate Property

- Family Heirlooms

- Valuables & Collectibles

- +More

Most people dread the process of estate planning. However, when you put the initial effort into gathering information before your first meeting, you can ensure that you can move through this process efficiently.

Estate Planning Lawyer NJ Infographic

What Should You Consider When Choosing an Executor for Your Estate?

Serving as an executor involves taking responsibility for some very important matters. People do not necessarily need a degree in law or accounting in order to serve in the role effectively. Nevertheless, they may need to tackle some complex tasks. Here are some of the key aspects of an executorship that you should be aware of when you are deciding who you would like to be in charge of your estate.

Availability Is Essential

The most fundamental criteria of being an executor is having the time and ability to serve. The person you choose should ideally live in or around the area where your estate is going to probate. If you live in New Jersey, for example, it may be advantageous to choose someone who resides in the same state. It is preferable to avoid choosing someone who must be away frequently for work.

An estate planning lawyer in NJ may suggest that you have a backup designated in case the person you choose is unable to serve. Having a second choice in place avoids worry and uncertainty about who will step into the role if your first choice is unavailable.

Accounting Know-How Is Preferable

The first step in administrating an estate is to conduct a comprehensive account of its assets and liabilities. This must take place before the distribution of any proceeds. Professional assistance may be necessary, but an executor should have familiarity with basic accounting practices.

Some of the steps that you take in the planning process may help to make an executor’s accounting duties easier. Keeping financial information well-organized and facilitating access to it can spare an executor from struggling to find key documents. An estate planning lawyer in NJ can offer useful insight on organizing financial documentation.

Executors May Need to Pay Creditors

An executor must convey notice to creditors that an estate is going to probate. The form of notice that an executor provides must comply with all applicable statutory requirements. When you work with an estate planning lawyer in NJ, you can get a detailed picture of what the notice process is like in your jurisdiction. After authenticating any claims from creditors, an executor can make arrangements to pay outstanding obligations using the estate’s assets.

Choosing the right executor during the planning process requires careful consideration. The beneficiaries of an estate rely on executors to help settle affairs quickly so that they can access funds and other types of assets as soon as reasonably possible.

What Is a Living Trust and Do I Need One?

A living trust is an estate planning tool that may help you avoid the probate process for some or all of your assets and minimize taxes on your estate. It is a living trust because you create it during your lifetime, and it can be either revocable or irrevocable. The primary differences between the two are whether you can take assets out of the trust if you choose to and how it is identified for tax filing purposes.

Revocable Living Trust

A revocable living trust can allow assets to be excluded from the probate process. The trust becomes active when you sign it, and it is set up using your Social Security number as the tax ID. The benefit of a revocable living trust is that you retain control of your assets throughout your life. You can move assets in and out of the trust, and if you want to, you can dissolve the trust completely. Once in the trust, assets become the trust’s property, but you as the grantor can act as the trustee and access them as you wish. While a revocable trust protects assets from the probate process, it does not protect them from creditors. The trust remains revocable until your death when it will automatically become irrevocable.

Irrevocable Living Trust

An irrevocable living trust becomes the owner of your assets and has its own tax ID number. Once the property is in this type of trust, it is usually there to stay until your death. Like the revocable trust, an irrevocable living trust can also keep the assets it contains out of the probate process. Once in the irrevocable trust, your assets belong to your beneficiaries under the management of the trustee you select.

While you typically cannot move assets out of an irrevocable trust, they are safe from your creditors as well as the tax liability on the income the assets generate. Since trust assets are held separately from your estate, you may be protected from estate taxes by reducing the total amount of the estate, possibly below the taxable threshold.

There are other types of trust designed to meet specific estate planning goals. Whether you want to avoid probate, minimize estate taxes or simplify the execution of your final wishes, a living trust may be the right tool for you. Note that state trust laws vary, so call our living trust lawyer to determine the laws in your state and schedule a consultation.

Setting Up a Trust for the Distribution of Assets to Children

Parents of young children are usually advised to ensure that they have written their wills and set up a trust in order to ensure that their children are taken care of if the parents die when the children are still minors. Trusts are usually recommended because of the complications of leaving property directly to minors. There are many different kinds of trusts, and the parents can set restrictions on how assets in the trust are to be distributed or used for the children’s care. An NJ estate planning lawyer can evaluate your situation and determine what is the best type of trust for your family circumstance.

One of the best aspects of a trust established under the law is that any assets passed to an heir in a trust do not need to go through probate before being legally transferred to the heir. Probate is a legal process through which a person’s estate is managed, settled, and distributed after his death in accordance with New Jersey law. Since the probate process can take years, a trust offers a significant advantage. Once a trust is set up, the trust, through a trustee, holds title to the trust property for the beneficiary of the trust. The person setting up the trust can also be the trustee.

As an NJ estate planning lawyer can explain, living trusts are popular for estate planning. They are set up while the grantor (the person setting up the trust) is still alive and can be designated as living revocable trusts or living irrevocable trusts. With a living irrevocable trust, the terms of the trust are set when the trust is set up and cannot be changed later on. However, with a living revocable trust, the grantor can make changes, or even get rid of the trust, at any point before his death.

Parents can also set up testamentary trusts, which spring into existence after the parents’ death, through their will. In a testamentary trust, the parents can leave all their property to the trust, for the benefit of the children. The trustee for the children’s trust can also be named in the will, and an alternate trustee provided, as well. Choosing a trustee is an important aspect of establishing trust and should not be taken lightly.

With all trusts, the parents can include specific instructions for how assets are to be distributed to their children, for example, requiring the trust assets to be distributed only when the child graduates from college. Parents should consider that sometimes a trust distribution that gives all children an equal amount regardless of age or need may not be in the children’s best interests. These are all details that an estate planning lawyer in NJ can make sure are addressed in your estate plan.

What Does an Executor Do?

You will most likely have a will as part of your estate plan. One of the items you will have to address in your will is who you want to oversee the distribution of your assets as specified in your will. This person is referred to as the executor. The executor is in charge of administering the decedent’s estate. This not only includes distributing assets and property per the instructions left in the will but also overseeing any other financial matters that the decedent had.

When a person dies, their estate is required to go through the probate process. Typically, either the executor or the NJ estate planning lawyer overseeing the estate will file the will with the probate court that has jurisdiction over the location where the decedent lived. This process typically takes about one year before the estate can be settled.

The first step is the probate system’s approval of the executor. If there is no will, no executor named in the will, the person named declines to be executor, or if the will is invalid, the court will also appoint someone as executor. The executor must be 18 years of age or older.

What Will the Executor Be Required to Do?

If a person knows they will be an executor, it can be very helpful to address certain issues long before the decedent passes away. This will make the executor’s job easier, as well as make the probate process smoother. The testator – this is the person whose will it is – can make a list of all of their assets and debts for the executor. This can include all bank and investment accounts, such as stocks, retirement accounts, etc. List all debts also.

The testator should also provide the contact information for their NJ estate planning lawyer. Giving information to professionals, such as financial advisors, is useful. They can also provide the executor with any funeral arrangements they have made ahead of time.

During the probate process, it is up to the executor to validate and pay all debts against the estate. The executor shouldn’t make distributions until after paying debts. The executor should also hesitate on taking a fee until debts are paid.

The executor also determines the estate assets. Estate assets may include stocks and bonds, real estate, vehicles, jewelry, collections, and any other items of value that the will may address.

Furthermore, the executor is also responsible for reporting all of this information as part of the probate process. An executor will find assistance from an estate planning lawyer in NJ valuable.

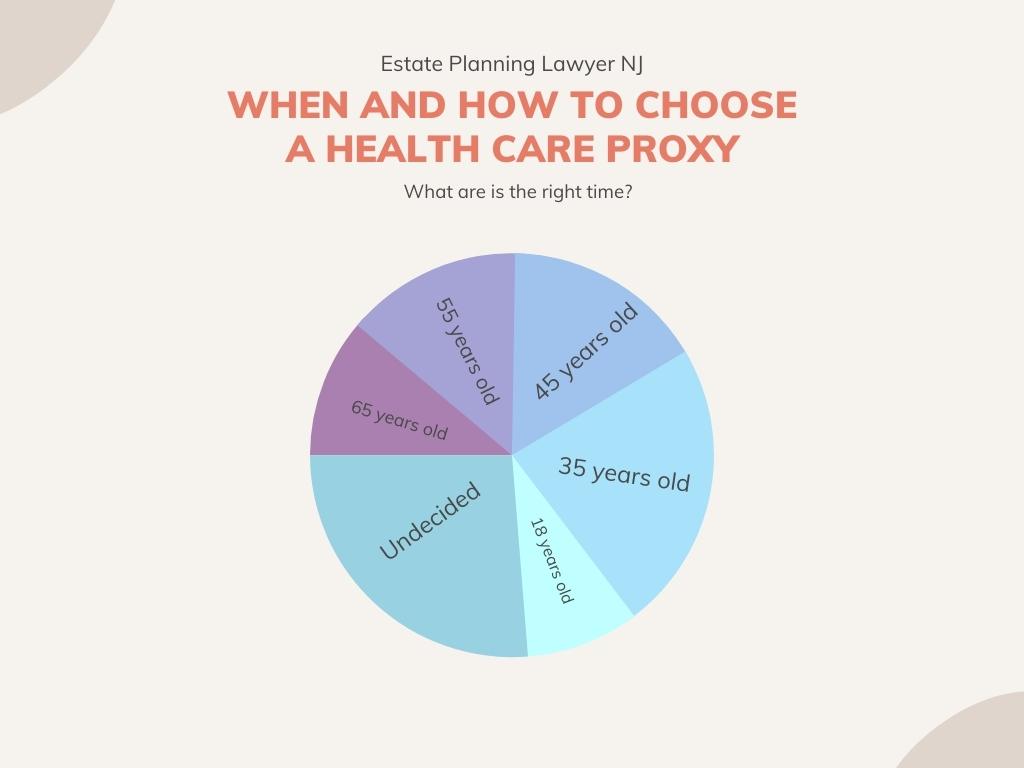

When and How to Choose a Health Care Proxy

When you turn 18 or 21, it’s a good time to consider designating a healthcare proxy. A healthcare proxy makes medical decisions for you if you become incapacitated. The reason 18 makes for a good age to choose this person is that after 18, no one can access your medical records without your permission.

An estate planning lawyer in NJ may also recommend choosing a health care proxy after major life events, such as going to college, getting married or divorced, being diagnosed with a serious illness, or having children.

After selecting a healthcare proxy, Klenk Law stands ready to help you review your choice every decade. Your chosen proxy should reflect your most current desires.

Deciding Who Should Serve as a Health Care Proxy

Because a proxy speaks for you and makes vital health care decisions, choose carefully. A healthcare proxy should make medical decisions that align with your desires. That means that even if your proxy does not agree with your wishes, she or he respects and fights for them, anyway. You also want someone whose emotional connection to you doesn’t keep her or him from doing the right thing for you.

With help from an estate planning lawyer in NJ, you can find a healthcare proxy willing to stand up for you, ask questions to better understand how to take care of you, and ask for clarification if he or she doesn’t understand something.

Because medical conditions fluctuate, choose a proxy who adapts well to change. For instance, she or he may need to decide whether you use a feeding tube or receive antibiotics. That doesn’t mean you should choose someone with a lot of medical knowledge. Instead, it means choosing someone who understands you and your values on a deep level and knows what you would want.

Rely on Our Team

Developing an estate plan may seem straightforward, but without a professional’s guidance, it can get complicated. To ensure that you receive an estate plan that leaves nothing to the imagination. With our help, you will receive:

- Professionals you can trust to manage your personal affairs discreetly

- Deeply committed lawyers who will work to ensure that your wishes are laid to plan in the way you wish them to be

- Guidance when making a difficult decision

- The opportunity to discuss and plan ways to ensure that your loved ones retain as much of your wealth as possible

- Experienced professionals who can make the process as stress-free as possible

- A transparent picture of the cost associated with our fees and the estate planning process

Why Choose Klenk Law for Your Estate Planning Lawyer in NJ

The average American dies with only about a third of their assets in place for family and loved ones. That’s because people don’t want to talk about death until they’re forced to. And when you do start talking about it, the legal language can be so complicated that many families simply give up on the process altogether.

When you need help with your estate plan, there are a lot of things to consider. The last thing you want is to feel pressured into making a decision that isn’t right for you or your family’s needs. At Klenk Law Firm, we take the time to listen and learn about our client’s goals and objectives so we can work together toward solutions that meet their unique needs. We don’t believe in one-size-fits-all solutions, because no two families are alike. If a cookie-cutter approach doesn’t make sense for your situation, then it certainly won’t make sense for us either!

If you’re considering an estate plan but haven’t yet made a decision about which lawyer to hire, then you need to know what makes us unique as New Jersey Estate Planning Lawyers. We can help advise you on how to get started with an estate plan or update one that’s already in place. In addition to our legal expertise and experience, we also have the knowledge necessary for financial planning purposes so be sure to ask us about tax savings strategies like life insurance trust funding!

Our goal at Klenk Law is not just to create documents but also to build relationships with our clients by helping them understand how these legal documents will impact their future well-being and peace of mind throughout life’s journey from young adult through senior years – and even after!

What to Expect During an Initial Consultation at Our Estate Planning Lawyer NJ Firm

During the first meeting, we will discuss your goals for the future and develop a strategy for making those goals happen based on state laws and federal tax laws in place at the time of your meeting. We won’t just talk about taxes; we’ll also discuss any other issues that may affect you such as health care directives or powers of attorney so that all bases are covered when it comes time to plan ahead for unforeseen circumstances. Our goal is always to make sure nothing happens without being prepared for every situation possible – which is why having a comprehensive estate plan in place is so important.

One of the most important aspects of estate planning is understanding the options available to you in order to make informed decisions about your future. That’s why our NJ Estate Planning Lawyer will work with you one-on-one to help you understand each step in the process and what it could mean for you and your loved ones.

Don’t wait until it’s too late to get started on your estate plan. Contact us today to schedule a consultation and find out how we can help you achieve your estate planning goals!

While there is no requirement in New Jersey that you leave any amount of assets for your adult children to inherit, many individuals do wish to pass on their wealth to their adult children and grandchildren, if any. Your intent is unlikely to directly leave any assets to your child’s spouse, but that does not mean that he or she will not indirectly benefit from the inheritance. The reality is that an adult child who is married is likely to share any inheritance with his or her spouse and combine it with other marital assets to use for various purposes. If you fear that your child might divorce in the future, or if you just are not a fan of your daughter-in-law or son-in-law in general, then you may want to structure your estate planning so as to prevent your child’s spouse from laying claim to your child’s inheritance. An estate planning lawyer in NJ can help.

How could my child’s spouse end up becoming an indirect beneficiary of the inheritance I leave?

One of the dangers of leaving an inheritance to a married adult child is that the child’s spouse will indirectly claim entitlement to the inheritance, one way or another. For instance, suppose your adult child passes away prematurely, which often will result in leaving your son-in-law or daughter-in-law in sole possession of any assets that belonged to your child. In this case, your child’s spouse may use the funds as he or she sees fit, which may frustrate the intent of your inheritance, particularly if you wanted the funds to go to your grandchildren.

As an NJ estate planning lawyer can explain, another problem might occur if you leave an inheritance to your child, who then, predictably, uses the assets, along with existing marital assets, to purchase a home or establish an investment account to benefit. Inevitably, this commingling of marital assets with the inheritance will indirectly benefit your child’s spouse. If the parties later divorce, however, the danger is that a divorce judge will determine that the inheritance proceeds are marital property for division between the spouses in the divorce.

What legal options do I have to avoid this from happening?

Probably the best way to leave an inheritance for your adult child while still preventing his or her spouse from indirectly benefitting from it is to establish a trust. For example, you could establish a lifetime trust that allows your child to access the principal for certain purposes, such as health expenses or education. In the event of your child’s death or divorce, then, the assets will belong to the trust, not to your child’s spouse. Upon your death, the trust’s beneficiary – your adult child – will become the trustee of the trust, which allows him or her to maintain control over the funds without actually owning them, thus continuing to avoid the death or divorce problem.

3 Tips for Beefing Up Your Nest Egg

No one wants to reach the time of their retirement and feel regret that they didn’t save more. And it can be particularly difficult if you aren’t prepared for retirement but find yourself less able to work as you grow older. It’s good to be prepared with a nest egg that will serve your and your family’s needs. Here are three simple tips for beefing up your retirement nest egg.

Take Advantage of 401(k) Plans

First, if your company offers one, take advantage of the 401(k) plan available to you. Many companies offer some kind of matching contribution, but even if yours doesn’t, a 401(k) plan is a great way for you to keep yourself on task and start assigning money specifically to retirement that you know you can’t (or at least shouldn’t) withdraw until later on.

Set Specific Goals

Another simple tip for achieving financial health long-term is setting real, tangible goals to meet. Not only should you have a general estimate of how big your nest egg should be, but you should think through the various ways that it will need to be spent over time. Important considerations here include your monthly living expenses, travel, long-term care, insurance, funeral expenses, and the inheritance you want to leave to your children. And it’s important to hire an estate planning lawyer in NJ to help you plan well. Klenk Law is a great firm with great lawyers who can help you do just that.

Buy Real Estate

Buying real estate doesn’t have to mean getting a multi-million dollar loan. It can simply mean choosing to buy a house instead of renting one with a long-term retirement plan in mind. Owning your home when you retire is a great advantage because you have both cut down your monthly living costs indefinitely and stored a good deal of value in an asset that will likely continue to grow. While the money tied up in your home isn’t liquid, it is a very sellable asset should you need to put it on the market later. Furthermore, owning real estate can pave the way for providing for your family after you’re gone. Be sure to talk to an estate planning lawyer in NJ, such as one from Klenk Law, to iron out the details of passing on your home to your children or other family members.

Incorporating these three tips can get you started toward a healthier financial future. While retirement preparation is more than just saving money, your finances are an important part of caring properly for yourself and your loved ones. And who wouldn’t want to have extra income to be generous within their old age?

It’s important to have your estate planning documents in order. The process can seem daunting, but it doesn’t have to be.

An initial meeting with your estate planning lawyer NJ from Klenk Law is a great opportunity to ask the kinds of questions that will help you understand your options and make decisions about your estate plan. It’s also a good chance to get a sense of whether you’ll be comfortable working with this lawyer.

Estate Planning Lawyer NJ FAQs

What is an estate plan?

An estate plan is a written document that details what you want to happen with your assets and who you want to take care of your minor children after you die. While some people think they don’t have an estate, every person has one, even if it’s small.

An estate planning lawyer in NJ from Klenk Law can also protect your assets from creditors and lawsuits, provide for the proper distribution of your assets upon death, and prevent any tax liability after death.

What are the benefits of having a trust?

A trust can be used not only as an effective tool in planning your estate but also as part of an asset protection strategy to protect your property against lawsuits before or after death. A trust can be used as an alternative to probate and may be more private than probate. Your property may pass to those you leave it to more quickly in a trust than under probate.

What is the difference between a will and a trust?

A will is a written document that states how you want your assets to be distributed after you pass away. It also names who should manage your estate during probate. A trust comes in two forms: revocable and irrevocable. A revocable living trust allows you to transfer legal ownership of your assets into the trust while you are alive. After death, the trustee appointed by you distributes your property according to the instructions in the trust. An irrevocable trust is created for the benefit of another person, such as a child or grandchild. You can’t change it, but it removes assets from your taxable estate which can reduce gift and estate taxes.

Do I need to update my estate plan if I move?

The laws for estate planning are not national, so every state is going to have its own laws that come along with varying nuances. Depending on the state a person moves to, the laws may greatly affect a current estate plan, or not much at all. Either way, it’s best to check in with your lawyer for reassurance that your estate plan is still valid based on where you relocate.

What if my relationships have changed?

One of the main reasons to update your estate plan is when your relationships change. Whether that means you got a divorce, married, had children, or experienced other new or fading personal dynamics. It’s ideal to revise documents as soon as possible so that chosen beneficiaries and assigned assets reflect current wishes. As your NJ estate planning lawyer can help you with, you may want to disinherit someone who is estranged from the family or known to be reckless with money.

Does a sudden increase in assets matter?

As your financial situation changes drastically, you will need to edit your plan accordingly. A substantial change in assets merits an estate plan review. Perhaps you recently sold real estate, launched a business, received an inheritance, etc. Your lawyer can identify where in your plan adjustments should be made. If you aren’t sure whether you even have to make changes, your lawyer can advise further.

Should I notify my beneficiaries?

The decision to let your beneficiaries know about the contents of your estate plan now will be up to you. Some people prefer to leave behind instructions for how they want their assets distributed and not inform their beneficiaries ahead of time. For others, they may want their beneficiaries to know beforehand so they can help ensure the estate is handled appropriately based on expressed wishes.

When do I need to hire an estate planning lawyer?

Estate planning lawyers in NJ can help people draft wills and trusts that ensure their heirs receive their property as they wish, and they can help clients decide how to reduce the tax burden on their estates. If an estate is large enough, an estate tax attorney can show you how to minimize estate taxes through the use of trusts and other strategies at both the federal and state levels.

An experienced estate planning attorney also can advise you on which type of trust meets your needs, whether it’s a revocable or irrevocable trust, a special needs trust, a living trust or a charitable trust. An estate planning lawyer in NJ who is familiar with all types of trusts can help you avoid unnecessary taxes and ensure your wishes are carried out after your death. Call Klenk Law today to get started planning your future

An estate planning lawyer in NJ from Klenk Law knows that most people don’t want to think about their departure from this earth. So surely, writing an estate plan isn’t always at the top of their to-do list, simply because it isn’t a fun thing to tackle. But thankfully, there are professionals who can help you get started, keep you going, and see that your legacy is protected. We know that what you’ve built is worthy of being passed down to future generations, so let us help!

Perhaps now more than ever, especially with a global pandemic, we are viewing and thinking about our lives more deeply. This is causing us to seriously assess what we want to leave behind. Part of preparing for our death entails establishing a legally-binding estate plan.

What is an estate?

Essentially, an estate is where you keep all of your assets, belongings, Investments, and money. The term estate may seem like a word that is used only to describe the wealthiest people, but in fact, everyone regardless of their financial status has an estate. For instance, your estate can be your vehicle, home, furniture, art collections, bank accounts, collectibles, family heirlooms, and everything else you own. An estate plan will protect an estate, along with ensuring that the assets are distributed based on the decedent’s wishes. An estate plan may have several documents, including:

- A Will

- A Living Will

- Power of Attorney

- Trust

Do I need an estate plan?

As a New Jersey estate planning lawyer knows, there are numerous excuses people may use to avoid getting started on their estate plan. For one, maybe they think that they don’t need an estate plan because they don’t have enough money. But as stated above, anyone no matter what their financial situation is can likely benefit from an estate plan. Secondly, most people don’t want to think about a time when they are separated from those they love most. Establishing an estate plan comes along with accepting the fact that we are all mortal, and have to take steps to protect the life and legacy we have built.

How can I get started?

Many people get started writing their estate plan by first thinking about the possessions they have, and then considering who they want to have them after passing away. Begin by writing a list of everything you own, both tangible and intangible belongings. Examples of tangible assets are items like your house and car. By comparison, intangible assets can be things like retirement accounts or bonds.

Call Our Firm for Help

If you would like to learn more about setting up trusts and other estate planning tool options, contact Klenk Law to schedule a free consultation with a dedicated NJ estate planning lawyer.

What Our clients are saying

A Google User

Peter Klenk was great in leading us in the estate planning process.He was clear in describing the various steps and what they would accomplish. We were well satisfied and pleased that we had Peter to guide us.

Kevin K.

I was referred to Peter after my divorce to put documents together to protect my assets. He suggested a number of documents that would help protect my children and their future. Also, he put together wills, power of attorney and living wills. I initially spoke with him on the phone, he took 30-40 minutes to understand my situation and explain the benefits of having such documents. After a week or two, I met with him in his office and signed the documents. Everything else was remote phone calls and emails. He re-explained these documents and what whom to share. I am in good hands.

Andrea Wilson

Peter is excellent. I had a very complicated situation with my parents' estate planning and potential Medicaid needs. Peter was very knowledgeable in estate planning matters, able to define the best solution for the situation. Additionally, he was congenial and able to communicate effectively to my senior citizen parents the benefits of estate planning. He earned my trust, and more importantly, my parents' trust in a 45 mins consultation period. Highly recommend Peter. He is very easy to work with.

CHARLES TOLL

Excellent, knowledgeable team handled a complicated issue with superb results.

Anne W.

I saw four lawyers and was told by all of them; I should just forget contesting my mother's will. I knew what happened, but it is very hard to prove undue influence. I contacted the Law Offices of Peter L. Klenk & Associates. Attorney Amanda DiChello took my case. They were very honest and upfront about what would be involved trying to prove what I knew was true. Attorney DiChello may be young but she is extremely knowledgeable and skilled. She listened and understood what I conveyed to her. She knew exactly what information to use and crafted an outstanding interrogatory and many powerful depositions. Attorney DiChello understood the various emotional feelings this case created for my family and me; she was always there for us with a kind and encouraging word. We went to trial. The amount of work which she and her Paralegal did for the trial was incredible. They both knew my case inside and out! Attorney DiChello's powerful interrogative and thinking skills produced a positive outcome. Attorney DiChello did what other seasoned lawyers said was impossible!

Let us put our expertise to work for you.

Free consultation within 24 hours.