Simplifying the Pennsylvania Rules of Intestate Succession

Who gets your property if you die without a last will and testament in Pennsylvania? This is legally referred to as dying intestate. Each state has enacted an intestate succession statute to address this issue. These statutes are government formulated and mandated estate plans. If there is no Will, these statutes how all of the deceased’s probate property will be distributed. Here is a link to Pennsylvania’s statute for reference.

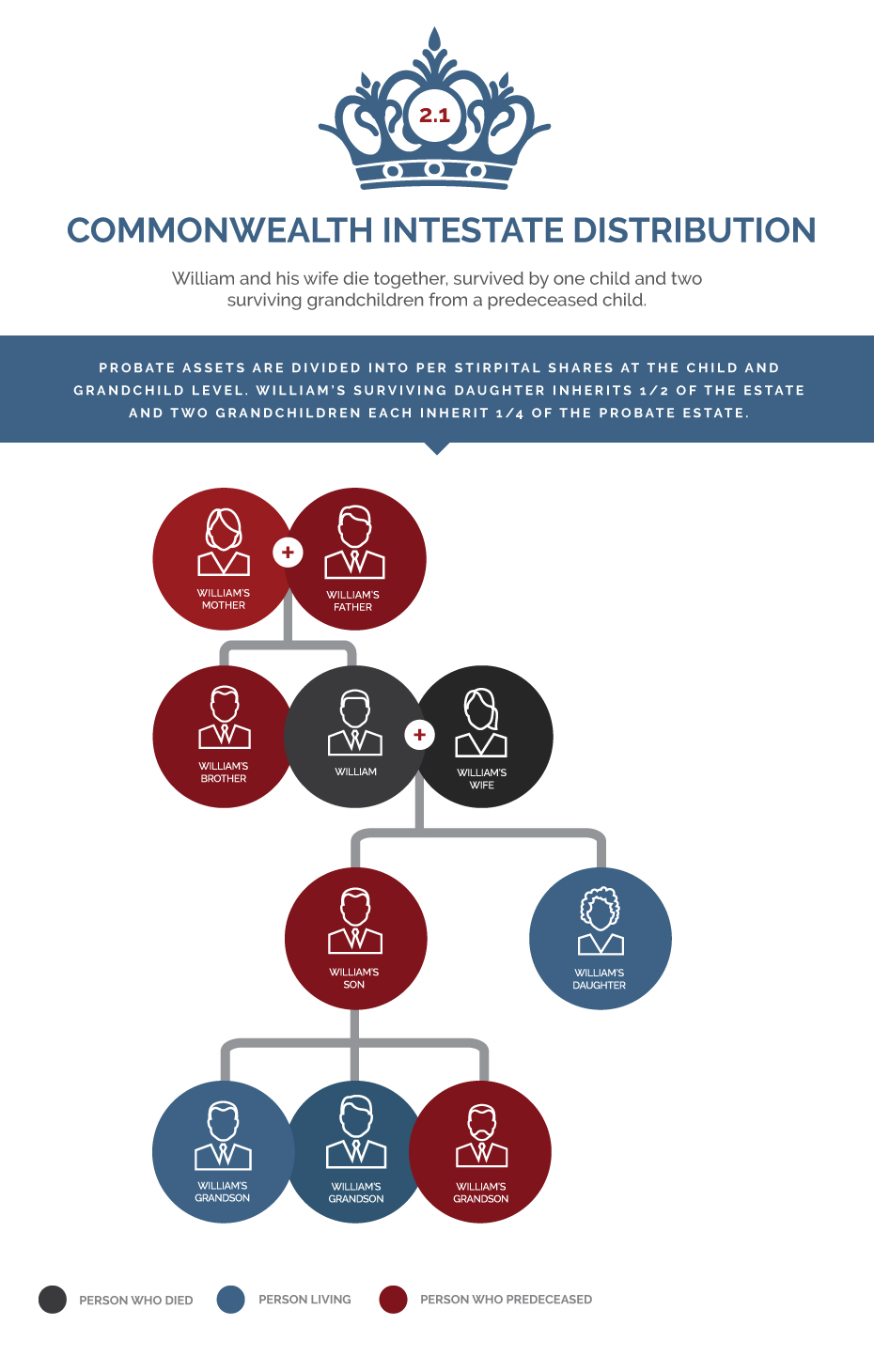

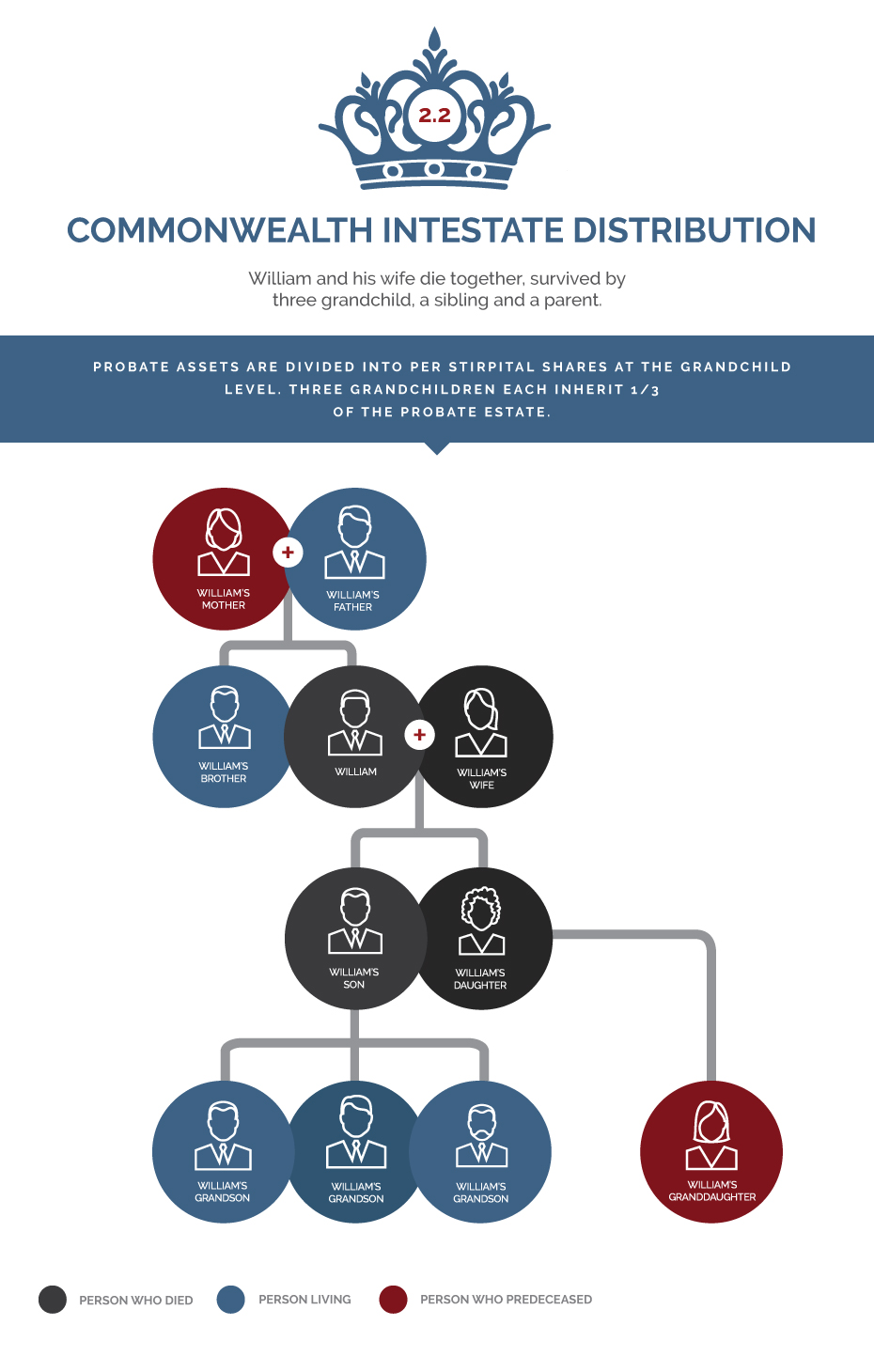

The answer to this inquiry depends which family members or relatives survived the person who died (the decedent) without a Will. This page seeks to explain in clear terms with simple examples what happens to a person’s probate assets if he or she dies intestate in Pennsylvania.

Before the examples begin, remember, property that is held joint with the right of survivorship or that has a beneficiary designation will not follow the intestacy statute. Each example below has a pictograph example, simply click on the box to the right. As always, please contact us for a free consultation if you have any questions.

Fairly Straight Forward Examples

We start with some fairly straightforward examples, then move onto more complex family situations at number 8 below.

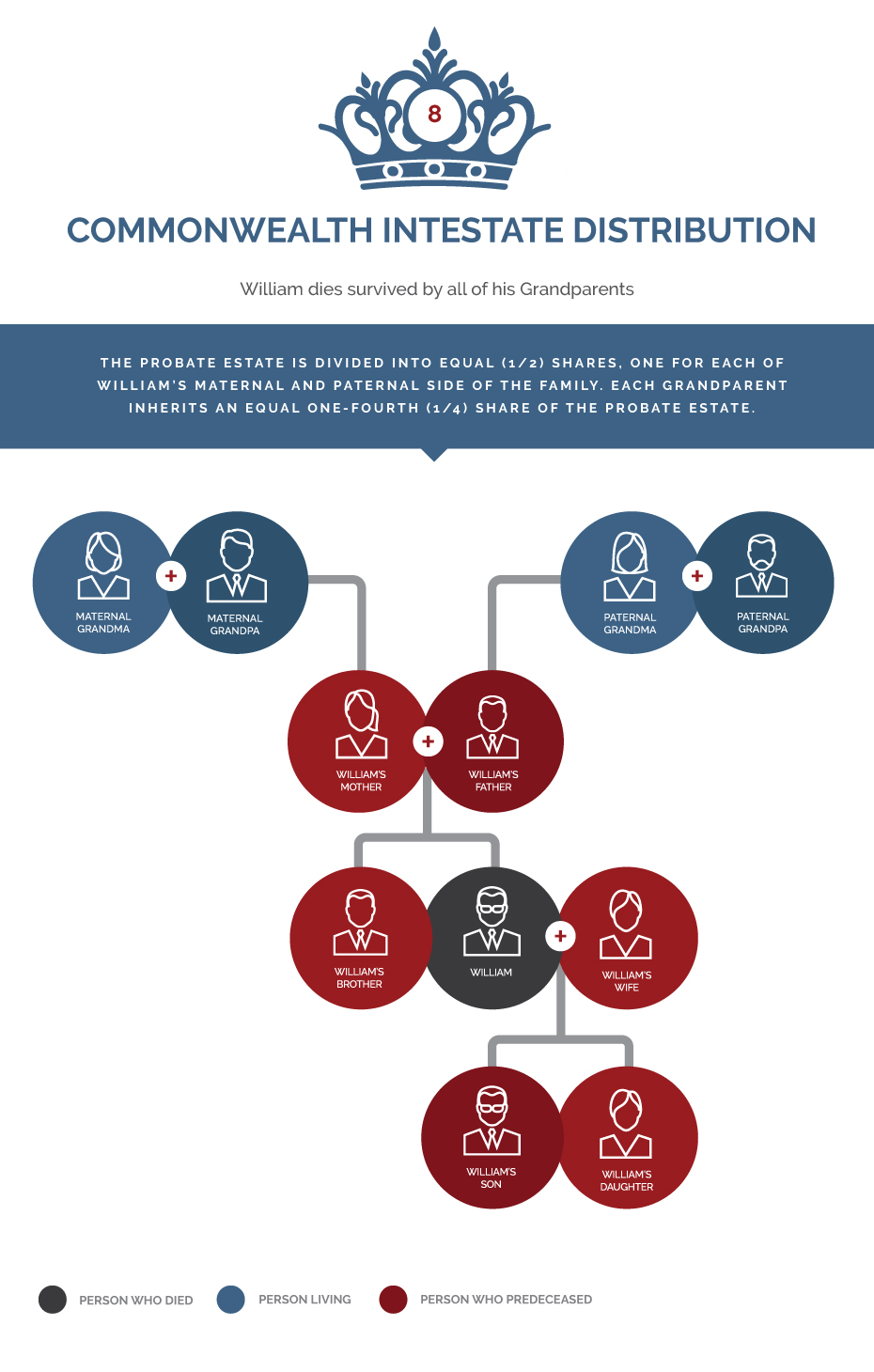

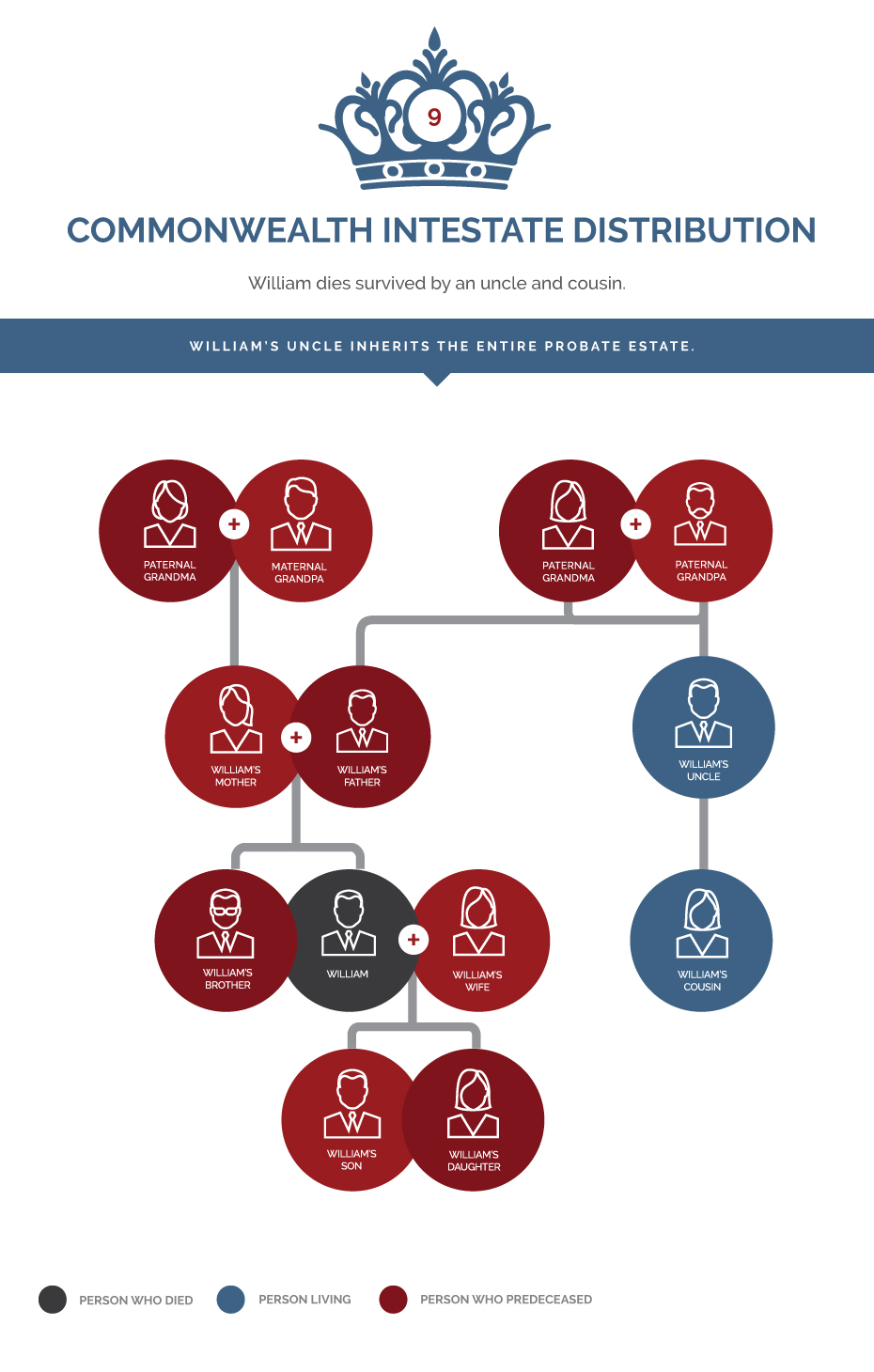

More Complex Examples; No Surviving Spouse or Descendants

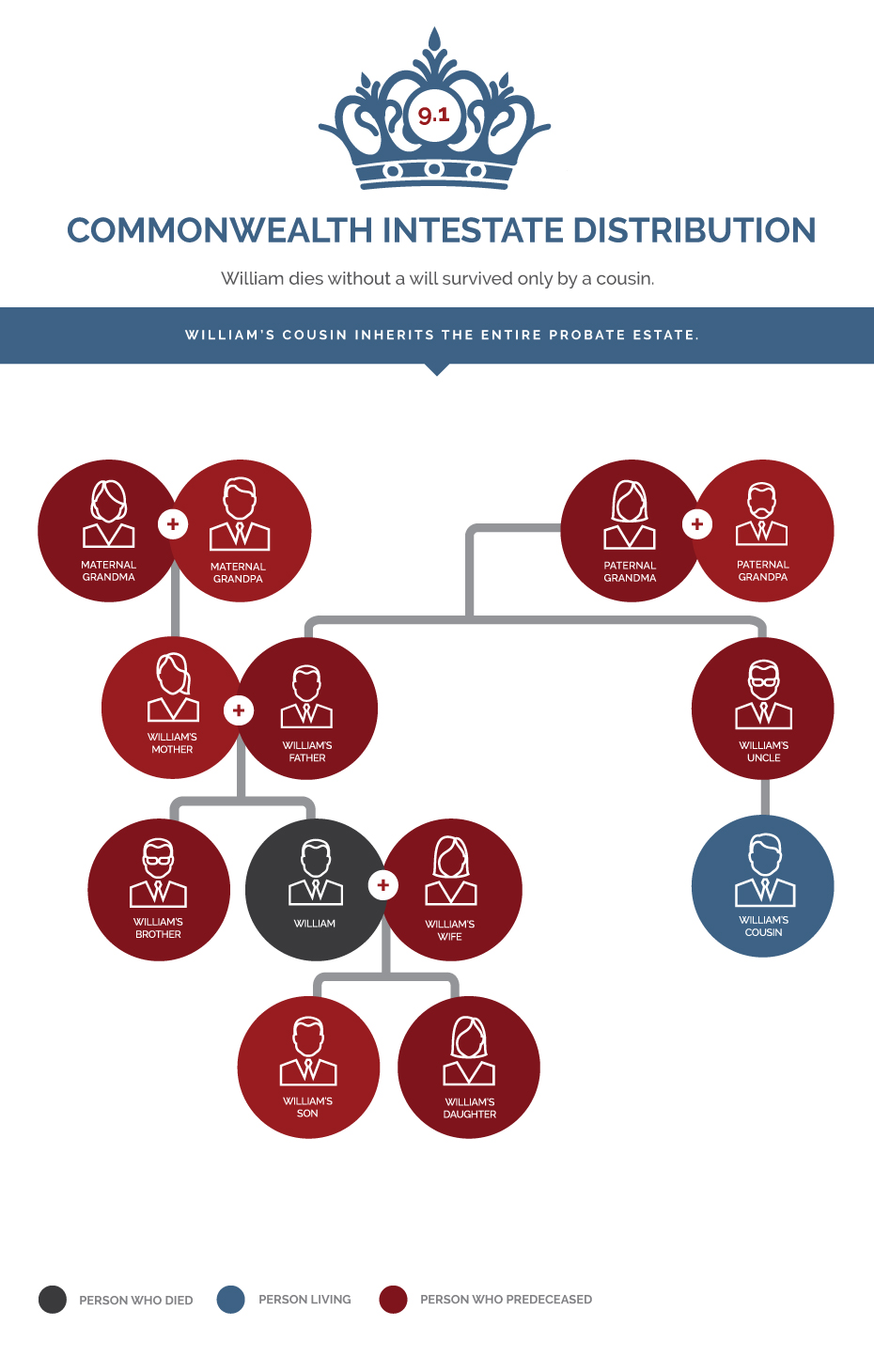

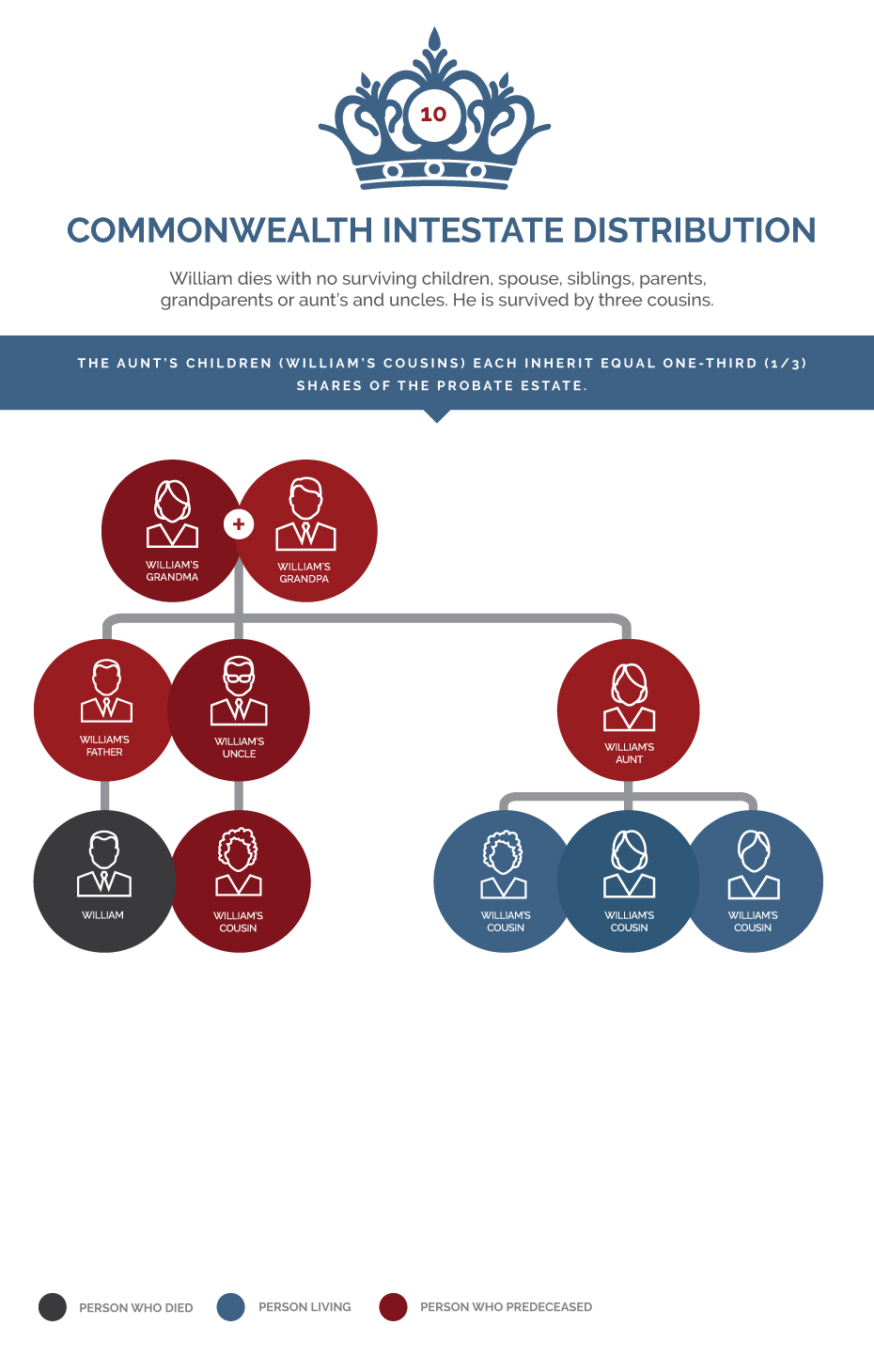

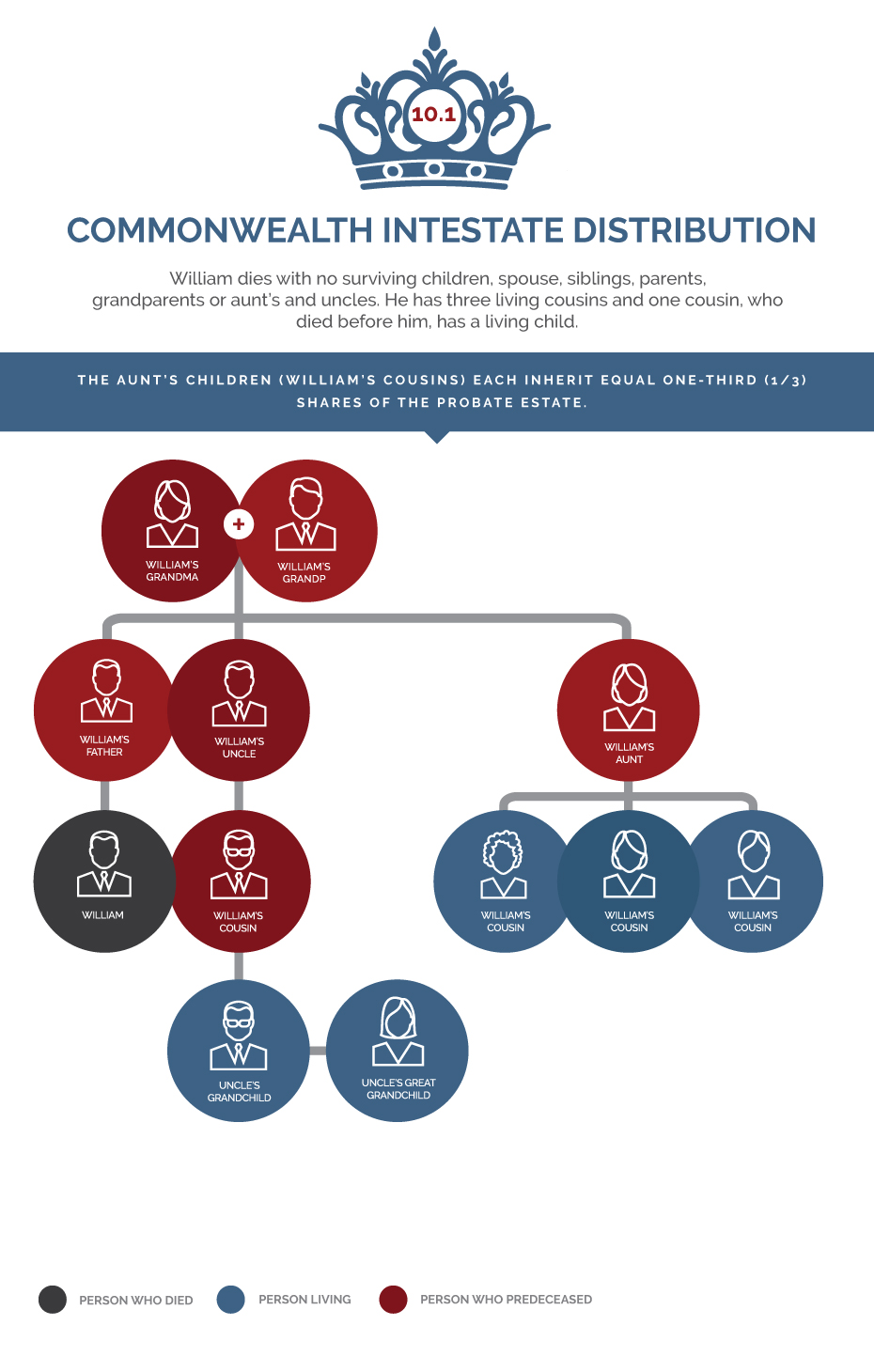

This is where our analysis becomes tricky. As long as there are living relatives of the decedent as distant as a child of a first cousin, the probate estate is inherited by a relative. Otherwise, the probate estate passes to the Commonwealth of Pennsylvania.

The first step of the analysis is to divide the probate estate into two equal shares; one for the maternal grandparents (and their descendants) and one for the paternal grandparents (and their descendants). Note: If there are no surviving relatives as close as a grandchild of a grandparent on the maternal side, but there are on the paternal side, no division takes place, and the estate passes entirely to the paternal side of the family and vice versa. In some examples, the discussion takes place solely on the paternal side however the same analysis is necessary on the maternal side.

I hope this review of a complicated subject has been helpful to you. If you have further questions about intestate succession in Pennsylvania, feel free to contact us for a free consultation with one of our Pennsylvania Probate Lawyers.

Disclaimer: The contents of this website are intended to convey general information only and not to provide legal advice or opinions. The contents of this website, and the posting and viewing of the information on this website, should not be construed as, and should not be relied upon for, legal or tax advice in any particular circumstance or fact situation. The information presented on this website may not reflect the most current legal developments. Further, this website may contain technical inaccuracies or typographical errors. No action should be taken in reliance on the information contained on this website and we disclaim all liability in respect to actions taken or not taken based on any or all of the contents of this site to the fullest extent permitted by law. An attorney should be contacted for advice on specific legal issues.

What Our clients are saying

Christopher F.

Peter explained things in a way that was easy to understand. Everything was done in the time frame he said it. Could not have been better!

Joe Peters

Always professional and very responsive. Everyone on the staff that I have worked with. I look forward to continuing our relationship.

B.A.

Peter Klenk and his associates are responsive and professional - It is a pleasure to work with their team. If you have needs in estate planning or administration, they are the firm to go to in the Philadelphia area!

A Google User

Peter is a model attorney who puts his clients first at all costs. His extensive expertise in estate planning and tax planning was a great comfort as we began, and have expanded, our family. He is very thoughtful, generous, and quick witted. His approach towards his business has been an inspiration to his peer group, and his zest for life is extremely infectious. Without reservation, I highly recommend Peter as trusted and cherished counsel

Chris Curcio

Fantastic customer service. Very personable and most importantly they provide great explanations of what is required based on your individual needs. Highly recommend Klenk Law for anyone that needs to create a will and estate documents.

Let us put our expertise to work for you.

Free consultation within 24 hours.