Posted on Fri Sep 9, 2016, on Trusts

From Our “Ask a Question” mailbag: “I am thinking about forming a trust for my minor child, but I read that a trust could be a “simple trust” or a “complex trust,” what is a complex trust?”

Posted on Fri Sep 9, 2016, on Trusts

From Our “Ask a Question” mailbag: “I am thinking about forming a trust for my minor child, but I read that a trust could be a “simple trust” or a “complex trust,” what is a complex trust?”

Klenk Law

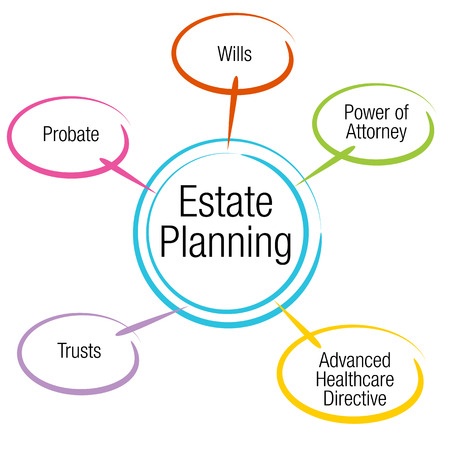

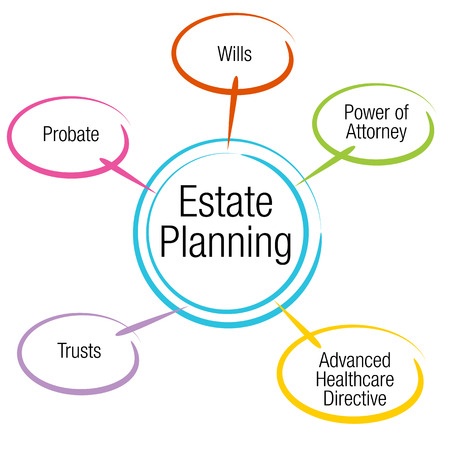

Posted on Fri Sep 9, 2016, on Estate Planning

From Our “Ask a Question” mailbag: “I am forming a trust for my minor children. I could use my brother as Trustee or choose a Corporate Trustee. What are the reasons to use a Corporate Trustee rather than my brother?”

Klenk Law

Posted on Fri Sep 9, 2016, on Special Needs Estate Planning

From Our “Ask a Question” mailbag: “I am setting up a Special Needs Trust for my son in my Will. I am trying to decide if I should pick my daughter or a bank as the Special Needs Trust Trustee. Who should I pick as the Special Needs Trust Trustee?”

Klenk Law

Posted on Fri Sep 9, 2016, on Revocable Trusts and Living Trusts

From Our “Ask a Question” mailbag: “I have been diagnosed with early stage Alzheimers. I have heard that setting up an “unfunded trust” for long-term care might be a good idea. What is an unfunded trust and how is a trustthat is unfunded useful?”

When planning for Alzheimers, the term “unfunded trust” refers to a Revocable Living Trust which you set up but in which you currently put no assets. Because it is currently not “funded” with any assets, we call it an “unfunded trust.”

Klenk Law

Posted on Thu Aug 25, 2016, on SLAT Spousal Limited Access Trust

From Our “Ask a Question” mailbag: “What is a Spousal Limited Access Trust?”

A Spousal Lifetime Access Trust, or SLAT, holds and shelters your gifts for your spouse’s benefit.

Klenk Law

Posted on Mon Jul 18, 2016, on QDOT Trust

From Our “Ask a Question” mailbag: Can a non-citizen spouse inherit land from me, a US citizen, even while a non-resident? My wife lives in India, but I have property in my name here in the United States.

Klenk Law

Posted on Thu Jul 7, 2016, on IRA Trust

The IRA Trust, An Underutilized Estate Planning Tool.

To ensure that your money passes on only to your direct descendants, consider forming an IRA Trust.

All qualified plans (IRA, Roths, 401ks, SEPs, TIAA-CREF, etc.) allow you to name a beneficiary to receive the plan at your death. But, if this person is your child, they will have the chance to defer income tax recognition by converting the plan into an “Inherited IRA”. BUT, with an “Inherited IRA” your child, not you, has the ability to name a beneficiary. And it is likely this beneficiary will be your daughter-in-law or son-in-law rather than your grandchildren.

Klenk Law

Posted on Wed May 4, 2016, on Special Needs Estate Planning

Our “Ask a Question” mailbag addresses the question, how to equalize inheritances with a special needs child.

“My estate is only large enough to provide care for my Special Needs child. So how do leave an equal amount to my other two sons? Is there a way to equalize inheritances with a special needs child with siblings?”

Klenk Law

Posted on Thu Jan 14, 2016, on Trusts

From our “Ask a Question” mailbag: My CPA told me that I should form a trust to help the save federal estate tax payable at my death. I think he may have called it a Revocable Living Trust. Is that good advice?

Klenk Law

Posted on Wed Dec 30, 2015, on Estate Planning

From our “Ask a Question” mailbag: My father has been diagnosed with the beginning stages of Alzheimer’s. He is having some memory issues, but is still doing very well on his own with one exception. My brother has always been the black sheep of the family. He has never held a steady job. He recently declared bankruptcy and has been pressuring my father to give him money and to change his will to give my brother more money. My father and my deceased mother’s wills have always divided their estate equally between the four children. My father has told me that he does not want to change his will, but that he is worried that as the Alzheimer’s progresses, he may give into the pressure my brother is putting on him. How do I protect my father from my brother’s undue influence?

Klenk Law

Peter Klenk is the founding member of Klenk Law, a seven attorney boutique estate planning law firm. We serve clients in Pennsylvania, New Jersey, New York, Minnesota and Florida. Peter Klenk received his Masters in Taxation LL.M. from NYU Law School and his J.D. from the University of Minnesota Law School. He served his country in the Navy JAGC during Desert Storm. Easy to talk to, feel free to call Peter for an appointment. We will make the process as easy as possible!

"I worked for Peter Klenk for 4 wonderful years. I can’t speak highly enough of everyone at the firm. Everyone truly cares about their clients and has a strong sense of responsibility to get things done right. I would highly recommend Klenk Law!"

Flora Novick

Klenk Law is an exceptional practice. Their fine lawyers and staff team up to produce excellent results for their clients. They excel at explaining the often cryptic laws and policies that govern estate planning right down to the complexities of the various "trust" frameworks. Peter himself manages each client together with his great team, and he has a rare quality to be both a walking encyclopedia of planning minutia and also one of the most likable lawyers I have ever had the pleasure of dealing with. He is truly generous in intellect and in his personal approach to getting the "big picture" for complex family structures. I trust him implicitly to help me make the right choices for the future. In short, Klenk Law is a gem of a firm.

Peter Klenk was great in leading us in the estate planning process.He was clear in describing the various steps and what they would accomplish. We were well satisfied and pleased that we had Peter to guide us.

Peter explained things in a way that was easy to understand. Everything was done in the time frame he said it. Could not have been better!

Professional, cheerful, thorough and fast. Peter responded to my request for a consultation right away, and within just a few days my last will and living will were done. Rates are standard.

Affable...yet surprisingly cerebral estate planning atty. High marks all the way around.

Let us put our expertise to work for you.

Free consultation within 24 hours.