What is a Complex Trust?

Posted on Fri Sep 9, 2016, on Trusts

From Our “Ask a Question” mailbag: What is a Complex Trust?

Most Recently Updated August 9, 2018.

“I am thinking about forming a trust for my minor child, but I read that a trust could be a “simple trust” or a “complex trust,” what is a complex trust?”

What is a Complex Trust? First, let’s define what a “Trust is.”

A Trust is an arrangement where one person (the “Grantor”) gives an asset to someone else (the “Trustee”) to hold for a “Beneficiary.” A Trust’s terms can be outlined on one printed page but can easily stretch over 50 pages. For example, in your case, you would be the Grantor. You create the Trust and give an asset to the Trustee. The Trustee holds the asset for your minor child who is the Beneficiary.

See my website for more information about Irrevocable Trusts and Revocable Living Trusts.

What Is the Trustee’s Responsibility?

Once you have placed an asset into a Trust, it is the Trustee’s duty to care for that property. This responsibility includes following the Trust’s terms as to investments. For example, if you contribute $100,000.00 into your trust, the Trustee should then examine the Trust’s terms to determine what is a reasonable way to invest that money. Once invested, the trust will have income, such as interest or dividends.

A Simple Trust Requires the Distribution of all Income; Complex Trusts do not.

A “Simple Trust” will demand the distribution of all income. A “Complex Trust” gives the Trustee discretion to either distribute the income or to hold the income within the trust. The word complex means that the trustee has more discretion, rather than the trust’s terms are more complicated. A tax return for a Simple Trust will show that all income passed out to the beneficiary. In contrast, a tax return for a Complex Trust might indicate that some income stayed in the trust. If the income stayed in the trust, the trust pays the income tax due.

What is Better, a Complex Trust or a Simple Trust?

Both types of trusts are excellent tools depending on the given facts. Both types have advantages and disadvantages. And, with more information, I could help you decide which is better for your beneficiary.

More Planning Questions?

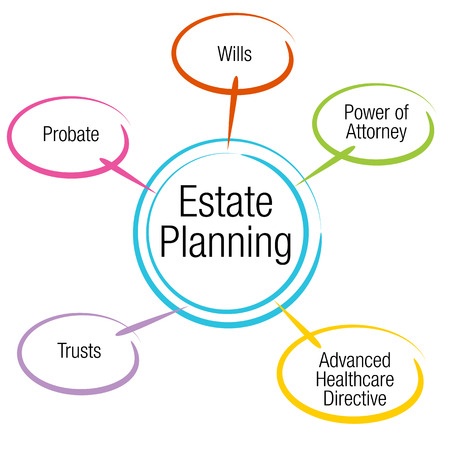

The Complex Trust is only a piece of the Estate Planning process. By all means, if you want to learn more, please read my more detailed article, Estate Planning Everything You Need to Know.

In Conclusion: Complex Trust

I hope that this article was helpful in explaining a Complex Trust. Further, I included links to even more detailed information on my website so you can learn more. Therefore, please contact me and let me know how I did. Certainly, your comments and questions are welcome!

Let our Estate Planning lawyers help walk you through what can be a confusing process. To begin with, call to speak to one of our experienced estate planning lawyers. By all means, our lawyers are ready to answer your questions. In fact, feel free to contact our office for a free consultation. Ultimately our goal is to make the process as painless as possible!

Wills, Trusts, Probate, and Estate Litigation, It’s All We Do!

Tags:

Complex Trust, Estate Planning, Estate Planning Attorney, Estate Planning Lawyer, Irrevocable Trust, Trustee, Trusts