Estate Litigation Appeals Lawyer Montgomery County, PA

If your family member has passed away and left behind an estate in Pennsylvania, you may wonder if you need to hire an estate litigation appeals lawyer Montgomery County, PA residents trust. In some cases, it may be necessary. In others, it may not be.

Here are a few situations when you should consult a lawyer.

Montgomery County Estate Litigation Appeals Lawyer

- You Want to Contest the Will

- The Deceased Had Two Families

- There Are Issues With a Trust

- Top 7 Estate Litigation Appeals

- Estate Planning and Communication with Your Heirs

- Mitigate Old Family Disputes

- Talk About the Value of Your Estate

- Discussing the Value of Your Estate

- Invalidating a Will By Showing Undue Influence

- How to Prove Undue Influence

- 6 Things To Know Before You Contest a Will

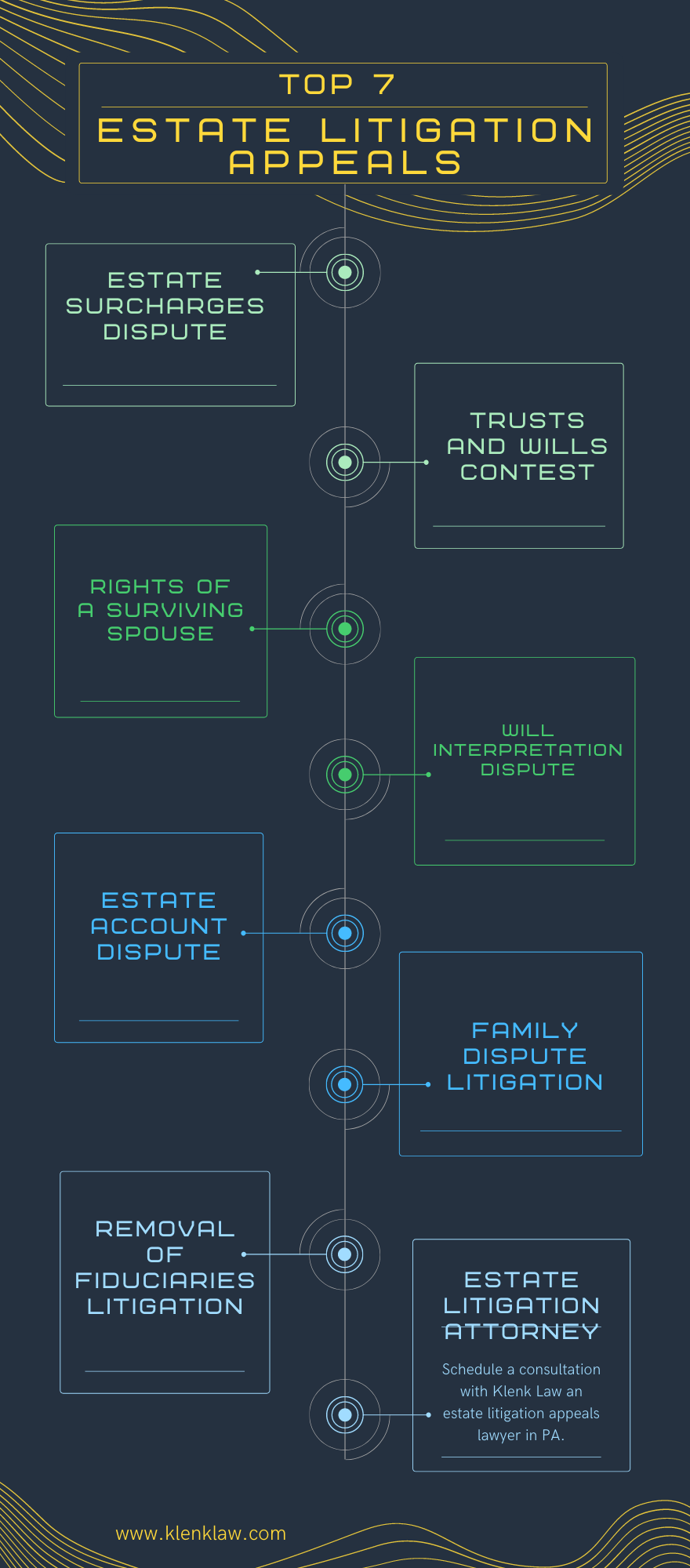

- Montgomery County Estate Litigation Appeals Law Infographic

- Klenk Law Montgomery County Estate Litigation Appeals Lawyer

- Montgomery County Estate Litigation Appeals Lawyer Google Review

- Call Our Office Today

- Schedule a Meeting With a Lawyer

- Estate Litigation Can Be Expensive

- If You Want To Contest the Will, You Must Do it Soon

- You Need the Right Estate Litigation Lawyer

- Most Cases Settle

- You Need To Have a Thick Skin

- Litigation Won’t Make You Feel Better

You Want to Contest the Will

If you have reason to believe that your family member’s will is not legal, you can contest it in court with the help of a lawyer. For example, you likely want to challenge the will if you don’t think your loved one didn’t have the right mental capacity when the will was created. It may also be necessary to contest the will if you think your family member was influenced by another person when writing the will.

Another reason why you may want to challenge the will is if you don’t think you are getting your fair share. For example, if your parent passed away and your other siblings are getting much more than you, it may be time to get a lawyer involved.

The Deceased Had Two Families

Disputes may arise when the deceased left behind two families. Generally, prenup agreements would clearly define how the assets of the partners should be allocated. However, if this is unclear in the documents, you may need to hire a Montgomery County estate litigation appeals lawyer to help divide the assets between the two spouses and children from both marriages.

There Are Issues With a Trust

If you’re the beneficiary of a trust, it may be necessary to seek litigation in certain circumstances. For instance, if you believe that the terms of the trust are worded incorrectly or the trust no longer can fulfill its purpose, you may want the court to amend them. It is also best to seek legal assistance if you think that trustees or fiduciaries acted against the duties assigned to them.

Top 7 Estate Litigation Appeals

- Estate surcharges dispute

- Trusts and Wills Contest

- Rights of a surviving spouse

- Will interpretation Dispute

- Estate account Dispute

- Family dispute litigation

- Removal of fiduciaries Litigation

Estate Planning and Communication with Your Heirs

A Montgomery County, PA estate litigation appeals lawyer knows that one of the most common reasons for contesting a decedent’s estate stems from miscommunication or lack of communication between the person who has died and their family regarding what his or her plans for distributing their estate were.

The first, and most important, step of estate planning is talking to your spouse, children, grandchildren, and whoever else you plan to name as a beneficiary, about your intentions. They have a right to know what your end-of-life plans are, and by hearing these plans from you, as opposed to an attorney or executor that they do not know, they will have an easier time adjusting to major changes when you pass away. Furthermore, this way they can play a role in your estate plan too if that is something that you think you might want.

Mitigate Old Family Disputes

When you pass away, old disputes and arguments will inevitably arise between siblings or other family members that have a history of not getting along. For example, if you remarried and left behind a prized possession to your current spouse that he or she had no use for, and instead could have given that item to one of your adult children, it could end up causing a large argument and increase tensions between your loved ones after you are gone. Talking to your family members about this could have prevented it from occurring in the first place.

Talk About the Value of Your Estate

In one major survey conducted by a national asset management company, 40 percent of participants said they did not feel that their parent’s estate was distributed fairly. Judging by how many families contact each Montgomery County estate litigation appeals lawyer from our firm, this is an accurate percentage.

Whether having a discussion with your heirs about your living will or trust is something that could change your mind or not, it could change the minds of your heirs about what is and is not fair. Explaining your decisions may be all that is necessary for everyone to feel included.

Discussing the Value of Your Estate

It may, or may not, be beneficial to talk to your family about the value of your estate, to let them know who is getting what, so as to reduce confusion later on and so that one family member does not feel left out when they, in fact, are being given an equal share of the estate. After all, money is often the primary cause of stress in relationships. Talking about the value of your estate may have its benefits by getting out in front of the issue.

Invalidating a Will By Showing Undue Influence

Family disagreements over a deceased’s family member’s will provisions can be very contentious, and the terms of the will may end up being contested in court. If the terms of the will disinherit one or more family members or leave a large portion of the estate to one person, the will may be challenged as having been the product of fraud or undue influence. A Montgomery County estate litigation appeals lawyer can help.

How to Prove Undue Influence

In claiming undue influence, the person challenging a will alleges that another person, usually one who benefited from the will, exercised such influence over the deceased that it caused him to make a will that benefitted the person instead of others. To show undue influence, the person claiming the will is invalid must show that the deceased was under such influence that the wishes expressed in his will were not really his wishes. A person challenging a will for undue influence must allege and prove facts that show precisely how another person used undue influence over the deceased.

In situations where the person benefiting from a challenged will was in a fiduciary relationship with the deceased, undue influence can be presumed. That is, the beneficiary is presumed to have used his position over the deceased to influence him to write a will that solely or disproportionately benefits the beneficiary. The presumption can be overcome by the beneficiary producing evidence that shows he did not unduly influence the deceased.

Will bequests to caregivers, whether paid or voluntary, are presumed void if challenged in court. This presumption is also rebuttable, meaning that if the caregiver can provide clear and convincing evidence that he did not unduly influence the deceased, the presumption no longer applies. However, the person challenging the will still have an opportunity to present evidence that there was undue influence. Therefore, the caregiver does not automatically win, with the will being declared valid if the caregiver – with the help of a Montgomery County, PA estate litigation appeals lawyer – can defeat the presumption.

In order to contest a will on any grounds, the person wishing to contest the will must have legal standing to contest the will. This means that the person has to have a direct interest in the outcome of the will challenge. This generally includes people named in the will, as well as people named in a prior will who stand to inherit if the most recent will is invalidated. Challenging a will can sometimes work against the interests of a person who inherits under the will if the will contains a clause aimed at discouraging will contests. A Montgomery County estate litigation appeals lawyer can evaluate the circumstances in your particular case and provide you with whatever legal options you may have.

6 Things To Know Before You Contest a Will

Estate Litigation Can Be Expensive

Any time you need to call a lawyer, it can get expensive quickly. A Montgomery County estate litigation appeals lawyer, will tell you about fees and billing up front. Some lawyers may work on a contingency basis, not collecting a fee until you win your case. That doesn’t make sense in all cases. Many lawyers at Klenk Law want to be paid up front for estate litigation.

If You Want To Contest the Will, You Must Do it Soon

Different states have different statutes of limitations — time periods in which you can act — for contesting a will. These may range from six months to 20 years, depending on the state and the circumstances. An estate litigation appeals lawyer in Montgomery County, PA, from Klenk Law could tell you that in PA, is generally one year.

You Need the Right Estate Litigation Lawyer

Any time you’re involved in litigation, you need to have the right lawyer by your side. A Montgomery County estate litigation appeals lawyer should have expertise in contesting wills and both obtaining a fair settlement or taking cases to trial. Make sure you ask prospective lawyers questions about their experience, how long they’ve been practicing and whether they specialize in estate litigation.

Most Cases Settle

After proceedings begin, your lawyer and the other beneficiaries’ lawyers will look for facts and trade information. They’ll talk about the merits of your case and what your chances might be if the lawsuit goes to court. Many clients get tired of fighting and become more amenable to settling out of court. Clients may also discover that their claim is weaker than they’d previously thought and elect to take a settlement rather than potentially lose in court.

You Need To Have a Thick Skin

When you contest a will, you’re starting a fight with your family. That can quickly land you in a minefield of accusations and blame. Your relatives may become vicious in their attacks on you, your mental state, and your character. They could fling ugly allegations at you and do whatever they can to discredit you. You’ll need to grow a thick skin to contest a will.

Litigation Won’t Make You Feel Better

If you have childhood trauma or a rocky relationship with the person who died, the unwelcome emotions you feel won’t magically heal if you successfully contest a will. Try to approach your lawsuit as if it were a business decision, with no big distress attached to it. There’s nothing you can do to get your loved one back. You may feel a sense of closure after successfully contesting the will, but your grief will still be there.

Montgomery County Estate Litigation Appeals Law Infographic

Klenk Law Montgomery County Estate Litigation Appeals Lawyer

1150 First Avenue Suite 501 King of Prussia, PA 19406

Montgomery County Estate Litigation Appeals Lawyer Google Review

“Best in town! Peter and his crews are so helpful. They make the whole process smooth and easy. I needed my Will to be done right away before I leave the country and they made it happen. Can’t be happier.” – Samantha C.

Call Our Office Today

Communicating with your heirs about your estate decisions is an important step to take to help avoid estate disputes. To learn more, contact Klenk Law to speak with a dedicated estate litigation appeals lawyer in Montgomery County, PA.

Schedule a Meeting With a Lawyer

If complexities have arisen in your family member’s estate, you should consider speaking to an estate litigation lawyer about it. He or she will assess your case and advise you on the best way to proceed. Your lawyer will protect your best interests and give you peace of mind. Schedule a consultation with Klenk Law a Montgomery County estate litigation appeals lawyer.

What Our clients are saying

Randi Greenberg

Jackie is amazing! I have asked her many questions and she answers them professionally and honestly. She is very informative !!!

Matthew Wentz

My experience with Klenk Law was nothing shy of amazing. I had done some quick research when searching for an estate attorney and was immediately drawn to Klenk Law being a veteran owned business and due to their support for veterans, first responders, and teachers . Every member of their staff was knowledgeable and patient through every step of the process and with all of my questions. They were honest and transparent with pricing and expectations. They were very timely with communications and kept me in the loop throughout the process. I will definitely recommend Klenk Law to friends and family.

CEGM

Peters' firm has prepared and updated our Wills and Trusts for the last 15 to 20 years. They know the law and help with your decision making to use the law to your best advantage. Response time to your requests is very reasonable, and final reviews and signing is executed in a timely manor with a thorough coverage of the documents. Our most recent updates to our Wills & Trusts were somewhat complicated, in our opinion, but Peter and his staff handled them effortlessly. As you can tell from this review Peter Klenk's firm is top notch.

Monika Patryn

I highly recommend this firm. Jackie was a pleasure to work with. I left there’s well educated and had all my questions answered.

Maureen O'Ryan

Peter Klenk was great at explaining complicated issues and making them understandable. He and his team were extremely efficient and I highly recommend them for the creation of wills and trusts.

Let us put our expertise to work for you.

Free consultation within 24 hours.